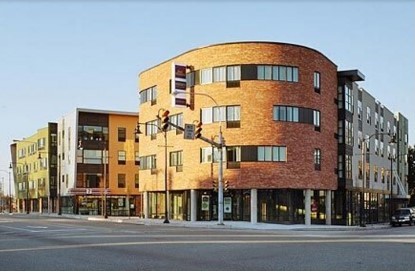

Charter School | Philadelphia, PA

Project Features: $5,170,000 Permanent Loan Refinance 5 year term with 25-year amortization at 4.25% Fixed Rate RPC closed a $5,170,000 permanent financing for a three-story 45,000 square foot charter school located in a former industrial loft building in the Temple Hospital neighborhood of North Philadelphia. The 75% loan-to-value loan was as a five-year term at […]

Charter School | Philadelphia, PA Read More »